This marks the 26th straight month of growth for condo rents and the 32nd for HDB rents. PHOTO: ST FILE

Updated from : The Straits Times, 30 March 2023

SINGAPORE – Rents for Housing Board (HDB) flats and condominium units continued to climb in February, even as fewer homes are being rented out, with some analysts noting a growing price resistance by some tenants in recent months.

Condo rents rose at a faster pace of 3.5 per cent in February, compared with January’s 1.4 per cent, according to flash figures released on Wednesday by property portals 99.co and SRX.

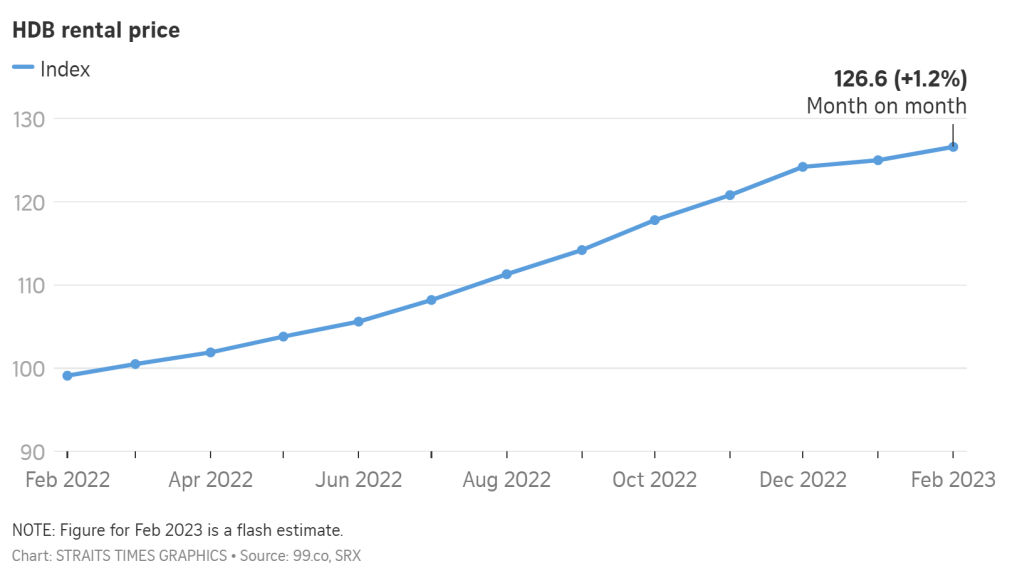

HDB rents went up by 1.2 per cent in February, versus 0.6 per cent in January.

This marks the 26th straight month of growth for condo rents and 32nd for HDB ones.

But, after a prolonged period of robust rental hikes, some property analysts said real estate agents have reported growing disparity between landlords’ and tenants’ expectations in recent months.

OrangeTee & Tie’s senior vice-president of research and analytics Christine Sun said tenants are starting to resist rent increases, but many landlords, after enjoying more than two years of elevated income, are holding firm to their demands.

“Landlords are facing increasing costs stemming from higher maintenance fees, property taxes and mortgage payments. On the other hand, tenants are unwilling to pay more, since rents have already risen substantially over the past year, with some areas reaching record highs,” she added.

This disparity has likely resulted in leasing activity slowing down in February, with fewer deals closing in recent weeks, noted Ms Sun.

An estimated 5,119 condo units were rented in February – an 18.6 per cent drop from the 6,285 in January.

On the HDB front, an estimated 2,619 units were rented in February, down by 7.2 per cent from the 2,822 in January.

Huttons Asia chief executive Mark Yip said the steeper increase in condo rents in February could be due to more new units being taken up. They tend to fetch better rents compared with older developments.

An estimated 174 units rented in February were in newly completed condos, compared with 140 such homes the month before, he noted.

But in view of global economic uncertainties, Mr Yip said, condo and HDB rents will likely continue to climb, but at a slower rate of 10 per cent to 15 per cent in 2023, compared with the more than 30 per cent hike in 2022.

Mr Pow Ying Khuan, head of research of 99 Group, said if condo rents continue to rise while volume consistently declines, tenants will turn to the more affordable HDB option – pushing up costs and transaction activity in this segment.

But an injection of supply – with close to 100,000 private and HDB homes set to be completed between 2023 and 2025 – could turn the tide in the current rental market boom.

At least 25 condos with more than 18,000 units are expected to be available for occupation in 2023. Owners who bought units for investment will likely put them up for rent.

About 15,000 HDB flats will complete the mandatory five-year minimum occupation period in 2023. This means they can be rented out.

ERA Realty key executive Eugene Lim said once home completions catch up this year, those who have been renting in the past two years will stop doing so, freeing up stock and cooling rental demand.

You must be logged in to post a comment.